AggLayer Use Cases That are Pushing Ethereum to Max Capacity

The Polygon Aggregation layer (AggLayer) has tackled almost all the challenges of a siloed and interoperability-lacking blockchain environment. Now, with a unified, interconnected, and fully interoperable ecosystem, AggLayer provides a common layer for blockchains despite the differences in their consensus, use case, network effect, and adoption. Such an innovative concept of AggLayer provides a suitable ecosystem for innovative use cases that are driving unprecedented growth to Ethereum. Let’s dive deeper and understand all the possible use cases and real-world applications on AggLayer.

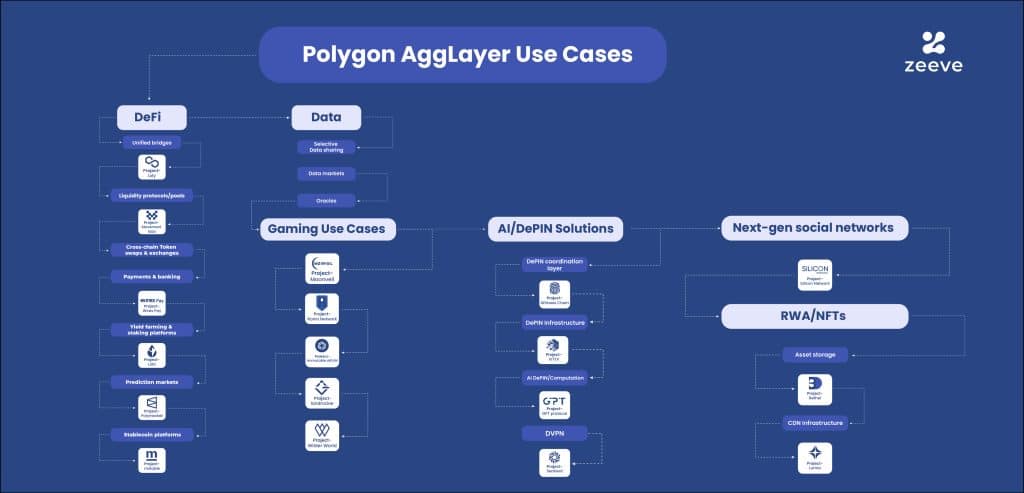

AggLayer Use Cases and Real-world Implications

Below is an in-depth analysis of Polygon AggLayer use cases that are driving the force behind Polygon and underlying Ethereum L1. Note that AggLayer’s top-most offerings; unified liquidity and cross-chain connectivity supports powerful and diverse use cases for DeFi. Hence, let’s first dive into DeFi use cases in a little more detailed manner:

1. DeFi

- Unified bridges- Bridges can integrate with AggLayer to become unified, connecting to Ethereum for seamless cross-chain transactions and transfer of native tokens. This means users on these bridges can access fungible tokens or assets from all the chains in the AggLayer ecosystem via a novel ZK-proof mechanism called pessimistic proofs. Unlike most bridges, AggLayer ensures that the influx & outflux of tokens remain fully under complete surveillance with zero interruptions from any third-party entities.

A Perfect application of this can be the LxLy that uses AggLayer for:- Quick transfer of tokens- send USDC from Ethereum to any chain.

- Send arbitrary & governance messages from PoS to any aggregated chain.

- Trigger token contract with custom messages.

- Leverage bridgeAndcall () mechanism.

- Liquidity protocols/pools: AggLayer’s unified liquidity is of utmost benefit for liquidity protocols or pools. Through the unified bridge and pessimistic proofs, AggLayer allows users to pool their fungible and unwrapped assets from a chain to their preferred chain using the unified bridge to earn rewards. No complexity will arise due to wrapped assets and fragmented liquidity, which often comes with order books and pools.

- While there’s no solid application of liquidity pools with AggLayer atm, we can look at Movement Labs; the network with over $160M TVL. Movement has joined AggLayer mainly because of its full-fledged liquidity pools. It allows all the Move-Based L2 to benefit from AggLayer’s liquidity pools, boasting massive TVL from leading chains.

- Cross-chain Token swaps & exchanges: Token swaps powered by AggLayer allow users to leverage different technologies, such as atomic swaps and cross-chain AMMs, to facilitate swaps and asset exchanges across all the interconnected chains with an enhanced UX via the BridgeAndCall() method.

- Payments & banking – AggLayer drives significant transformation to the payments and banking-related ecosystem by tackling key issues like lack of cross-chain access, liquidity fragmentation, and problems in data sharing. To understand the specific benefits, let’s look at its real-world application– Wirex Pay. The platform is using AggLayer’s 4 key innovations;

- Advanced staking mechanism: This ensures a refined staking process and transactions validation process while also heightening network security & overall integrity.

- Seamless asset transfers: Rapid and smooth asset transfers between different blockchains without causing the usual friction of cross-chain transactions.

- Cost reduction & speed: Agglayer optimizes operational costs for Wirex Pay while also speeding up transactions and offering benefits to both users and networks.

- Scalability and Flexibility: With AggLayer, Wirex Pay gets the flexibility needed to scale operations and expand its users and services with no disruption in the existing systems.

- Yield farming & staking platforms: AggLayer enables the development of cross-chain staking and yield farming platforms that allow to;

- Diversify Investments: Stake assets in different chains to mitigate risk and enhance potential returns.

- Increase Liquidity: Access liquidity from various sources, enabling more efficient capital allocation.

- Maximize Rewards: Take advantage of staking rewards across multiple protocols, leading to higher overall yields.

A good example of this is Lido– Ethereum’s leading staking platform, having a TVL of $25.26B. Lido is expanding liquidity on its network through AggLayer’s untapped liquidity of $1.4b approx. Also, Lido seeks to utilize this liquidity, unified interoperability, and the power of pessimistic proofs for its re-staking vaults building in collaboration with Mellow Fiance.

- Prediction markets- Polygon AggLayer enhances prediction markets by enabling cross-chain liquidity aggregation, allowing users to access deeper liquidity and better pricing across different blockchains. It reduces transaction costs by leveraging Polygon’s low-cost Layer-2 solutions, making markets more accessible. The AggLayer also enables seamless cross-chain participation, letting users place bets across multiple platforms, improving market efficiency. It enhances data flow and analytics, supports tokenized prediction markets using stablecoins, and facilitates cross-chain governance for decentralized market management. Overall, Polygon AggLayer boosts scalability, reduces friction, and fosters a more integrated, cost-effective, and dynamic prediction market ecosystem.

Polymarket can be a good example here. To ensure seamless operations and superiority on its platform, Polymarket taps into DeFi TVL, token inflow, and the daily active user base that AggLayer aggregates.

- Stablecoin platforms- Polygon AggLayer ensures seamless functionality and efficiency on stablecoin platforms through an optimized, low-cost, and interoperable environment. Any Stablecoin integrated with AggLayer will benefit from inter-chain stablecoin transfers, liquidity aggregation, lower transaction costs, interoperability between different stablecoin & collateral platforms, plus a frictionless redemption every time.

Many Stablecoin-backed organizations and TradFi giants are building on Polygon to benefit from its AggLayer solutions. These include HSBC, IDA, and Evident Capital. Also, ambitious projects like mStable can connect to AggLayer to contribute its massive TVL with the chains in the AggLayer ecosystem.

Besides these mainstream DeFi use cases, there can be powerful AggLayer use cases in Insurance, DAOs, Wallet chains, Derivative exchange/trading platforms, and more.

2. Data:

AggLayer bridges data gaps, allowing the data to flow seamlessly across different networks, hence providing infrastructure for the below novel data use cases:

Selective Data sharing- Different chains in the AggLayer ecosystem can voluntarily participate in data sharing between sovereign chains and ecosystems, similar to how LAN and WAN serve in traditional systems. This allows enterprises to build innovative use cases for data disclosure and specific audit rules.

Data markets- Similar to unified NFT and DeFi liquidity, AggLayer also presents promising opportunities for on-chain data markets. It allows users for better control and utilization of data despite the rapid growth of the aggregated chain ecosystem.

Oracles– AggLayer offers a shared execution environment for oracles, enabling them to fetch and provide data to multiple chains without setting up separate systems for each chain. Hence, Oracles benefit from faster data propagation enabled through a single, unified interface created with AggLayer.

Also Read: How Aggregation Layer Brings a New Phase in Rollup Interoperability?

3. Gaming Use Cases:

For gaming applications, a fragmented blockchain ecosystem presents critical challenges related to UX, developer experience, adoption, and more. Polygon AggLayer tackles all these issues through:

- Interoperability-enabled design space: Agglayer offers a gaming ecosystem where players and in-game assets can move freely across different chains. Game developers can build unified reputation systems, for example- Moonveil’s ‘ecological identity’ designed to track players’ unique behaviors, achievements, and rewards. This means, value of one game can be translated into another game’s value.

- Easy onboarding: AggLayer simplifies the entire process of user onboarding. Whether it’s a CEX, a gaming chain, or a wallet- everything is created as an ecosystem where users and players can tap into existing liquidity while benefitting from secure and smooth cross-chain transactions.

- Extended ecosystems: Instead of discouraging players with complex, multi-step processes to engage with new games in AggLayer ecosystem (Ronin or Immutable), the AggLayer allows users to access all the games seamlessly, just like the experience with Xbox or Playstation games.

A prominent example of this is Ronin Network that has 1.5M+ daily active users, $9.41 B All-time DEX Volume, and $4.2+ B NFT Volume. The gaming platform is turning into an Agglayer-based L2 to combine its modular and monolithic scalability approach, unified liquidity, easy onboarding, and more. Regarding Ronin’s shift to AggLayer, Sky Mavis– The co-founder and CEO of Ronin, said that their key goal is to create a unified gaming ecosystem for facilitating effortless asset exchange, token swaps, and inter-chain NFT trading– all whole offering low gas fee and excellent UX.

Also, there’s Immutable zkEVM, LandRocker, and Wilder World (Metaverse marketplace) that are taping into AggLayer’s unified liquidity, atomic cross-chain transactions, seamless user experience (UX), cost-efficiency, and robust security.

4. AI/DePIN Solutions:

Fragmented infrastructure presents the challenge of Silos for the AI/DePIN solutions, resulting in the complexity of data sharing, computing, custom reward mechanisms, and problem of off-chain/on-chain compute. Also, fragmentation has a direct impact on platform’s overall cost and interoperability. To solve this, AggLayer offers:

- AggLayer solution: Enables easy integrations and better inter-chain data sharing.

- Seamless integration: Allows AI systems to work together in interconnected systems.

- Robust security: Built-in advanced security mechanisms to ensure trust and cross-chain interactions.

- Accelerated innovation: Easier interoperability and data sharing for rapid development.

- Lower costs: Standardized protocols reduce the need for expensive custom setups.

Speaking about AggLayer applications for DePIN/AI projects, we’ve the top projects added below:

IoTEX, the modular DePIN platform with 500+ projects and 122.2M transactions, has confirmed its integration with AggLayer for unprecedented cross-chain DePIN liquidity & scaling opportunities and meanwhile allows IoTex projects to ensure fair reward distribution as users can now settle on their preferred chains. Also, AggLayer will maintain privacy on IoTex as pessimistic proofs allow parties to prove validity of statements without reveaing the actual data.

Also, there’s GPT Protocol with 65K+ transactions, 2.2s blocktime, 1.5k+ holders, and 74K+ blocks. The protocol is building an AI-powered Internet that verifies AI data and provides rewards to users for contributing their computing power. Polygon Agglayer allows GPT Protocol to maintain sovereignty while having interoperability for hassle-free on-chain/off-chain computing.

Other good examples for projects are Sentient (AI dVPN) and Witness chain: DePIN Coordination Layer (DCL) that are utilizing DePIN unification layer based on AggLayer.

5. Next-gen social networks:

Polygon AggLayer supports the creation of futuristic social networks that are optimized for enhanced cross-chain interactions, limitless scalability, low-cost microtransactions, greater privacy & more. By leveraging these features, social networks can empower a strong, thriving community for social interactions.

An example for this is Silicon, an innovative social network designed for hyper-personalization. Silicon allows individuals of similar interests to connect across a transparent blockchain, enabling faster network finality, lower fees, greater control of data, and uninterrupted cross-chain communications with Polygon AggLayer.

6. RWA/NFTs: Polygon AggLayer and its unmatched features act as a catalyst for on-chain storage solutions built for RWAs. From boosting liquidity for seamless asset transfecr to offering fractional ownership, simplified cross-chain transfers, and improved compliance and security aspects, AggLayer is pushing the boundaries of innovation for RWA solutions.

A real-world example is Bethel, which has announced integration with AggLayer. Bethel utilizes Agglayer to bring a seamless multi-chain experience for its ZKP Storage products. AggLayer allows Bethel to ensure secure data storage and concealment of sensitive data. Also, AggLayer offers cross-chain communication and unified liquidity for Bethel.

Also, there’s Lumia, the CDN infrastructure that uses AggLayer’s benefits like low-latency cross-chain transactions, scalability, enhanced liquidity, security, and flexibility.

Integrate AggLayer Easily with Zeeve RaaS

The rollup stack at Zeeve is optimized to support diverse Polygon AggLayer use cases. Enterprises, Web3 projects, and independent developers building CDK-powered ZK chains or running an existing chain with any stack can integrate Polygon AggLayer easily with Zeeve RaaS. With Zeeve, you can enable modularity for your chain with an altDA layer, decentralized sequencer, account abstraction services, and 40+ third-party integrations. Also, users can set up a full-fledged CDK chain testnet with Zeeve’s 1-click Polygon CDK Sandbox tool in minutes.

For more information about Zeeve RaaS offerings and comprehensive blockchain services, connect with our experts. You can write your queries/concerns via mail or set up a 1-on-1 call for a detailed discussion.

Would love to learn more about DeFi usecase solutions…especially bridges. USDC on ERC20 sent to any chain? Let’s discuss more!