The Powerful role of Composability of Smart Contracts in DeFi

You’ll receive a wide range of responses if you ask blockchain-embracing companies & individuals what they find most intriguing and fascinating about DeFi. Some will respond, “Decentralized,” which is obvious. To break free from relying on other companies to own our data and money, we are reinventing the financial system without any middlemen.

Some will say that it is globalized. Since there are no middlemen, we are free to send and receive money from anyone, creating the truly global economy that the Internet foresaw more than 50 years ago. But the constructability of decentralized finance is what’s most intriguing.

DeFi is taking the world by storm. Don’t believe us? Well, it generated a $4.5 billion cumulative revenue in 2022. Composability of smart contracts in DeFi allows this revolutionary financial concept to be more globally accessible, and companies will witness a rapid pace of innovation. Thus, interact, build and improve the existing DeFi ecosystem.

By composability, blockchain-adopting industries will have nothing to build from scratch and have to bring together the missing components. Let’s dig deeper into the composability of Smart Contracts in DeFi and how it plays an important role.

About Composability of Smart Contracts in DeFi

Composability is one of the central features of decentralized finance. It allows for the creation of complex contracts that can be used to create new applications or interact with existing ones. With DeFi, you may interact with protocols in countless ways and arrange your actions as if they were bricks of construction. Composability is what enables you to use Aave’s lending and borrowing protocol to exchange a DAI for an aDAI in Monolith and earn interest on it.

The interoperability of components inside a design system is referred to as “composability.” Different components can function in many combinations in a system that is more composable. We’ll describe the impact of smart contracts’ composability on the DeFi ecosystem in this feature.

Principles of Composability of Smart Contracts in DeFi

As we know, Ethereum smart contracts are public APIs, and anyone can integrate the dapps with them. The three principles of smart contract composability are:

- Modularity: One component, one task is what the modularity represents. Every smart contract has its own specific application, and the composability feature improves modularity as well

- Autonomy: The composable smart contracts can operate independently without relying on other functions.

- Discoverability: Forking the codebase and using smart contracts with external contracts becomes possible with composability.

The Advantages of Composability Features in Smart Contracts

The composability of smart contracts can assist developers and industries in the following ways:

- Developers can incorporate smart contracts from a wide array of industries to understand the functioning of different marketplaces. The companies would be able to attract more audiences and strengthen their communities.

- Developers can effortlessly bootstrap the projects and communities instead of building anything from scratch. This is possible as smart contract platforms are open sandboxes where innovation can be done quickly.

- The user experience in the ecosystem improves as the interoperability between the components enhances with composability.

- Enterprises or organizations can plug into open ecosystems and improve their efficiencies. Companies can launch tokens and let users employ them in the existing wallets.

- The composability feature acts as a binding element for the DeFi ecosystem and brings together DEX, collateralized protocols, lending and borrowing, leveraged trading, synthetic assets, etc.

Use Cases of Composability in Ethereum

The Ethereum smart contracts are like the public API, meaning anyone can interact with it and further integrate it with dapps. Three major use cases of the smart contract composability for Ethereum are:

Token Swaps

Token swap logic is helpful for the users as it allows users to pay in other ERC-20 tokens and the smart contract code will convert the token to ETH. The decentralized exchanges are non-custodial and rely on the liquidity obtained by liquidity mining.

Governance

The governance framework is difficult to form and is expensive as well. An open-source governance toolkit will bootstrap the DAO and create the framework in less time.

Identity Management

The identity management, due to the composability of the smart contracts, improves as instead of creating a custom authentication the developers can integrate the decentralized identity tools for identity management. An open-source toolkit with “Sign in with Ethereum” helps the users authenticate identities.

How composability of Smart Contracts in DeFi affects

The dapps function by the smart contracts and are there to facilitate the exchange of services. The decentralized finance applications leverage smart contracts for trading, borrowing, lending, stablecoins, derivatives, etc.

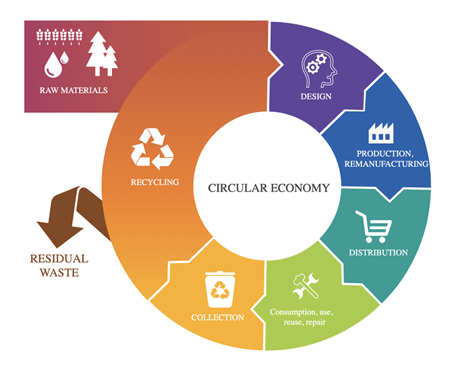

Defi is built on the principle of composability. This means that different smart contracts can be combined to create new financial instruments and applications. This allows for a huge amount of flexibility and creativity in the development of new services and products.

Composability is what allows Defi to offer such a wide range of services and to continue to grow at such a rapid pace. It is one of the key features that make Defi so unique and powerful.

With the help of smart contract composability, Decentralized finance has opened up new possibilities unlike anything in the traditional world. DeFi allows you to do a lot of different things, such as exchange value, borrow assets, take out loans, earn income, join liquidity pools, mint stablecoins and other synthetic assets, and much more.

The new form of financial service

DeFi apps are similar to Legos. You can choose which DeFi apps to mix and match to create a whole unique financial product. You can interact with them in many ways, obtaining a degree of capital efficiency which is far superior to the established system. Due to the modularity of DeFi programs, Ethereum is frequently referred to as the Infinite Machine since it is a platform with limitless potential.

Examples of Defi’s money legos:

Yearn.Finance:– Yearn is an auto investment product. The optimal returns for the user across each integrated protocol are determined via smart contracts. It uses composability and enables the user to utilize their assets, saving on gas costs as opposed to moving their money between each protocol.

Synthetix:- A liquidity protocol for synthetic assets is called Synthetix. Users can mint “Synths” of assets like stocks, gold, precious metals, cryptocurrency tokens (BTC, ETH), and even fiat currencies (USD, AUD) by depositing SNX. It makes use of the DeFi protocol’s modularity by using the decentralized oracle Chainlink for price feeds.

Risk of Composability of Smart Contracts in DeFi

Despite being a core of DeFi, there are a number of threats to the ecosystem’s composability. Any blockchain like Ethereum carries a protocol risk; if the base chain were to be attacked, every application created for the network would also be at risk.

DeFi also carries smart contract vulnerabilities. Any flaw in a contract’s code might ruin a protocol and possibly have an impact on other connected applications. Attackers have used flaws to steal money from protocols, frequently using flash loans to increase their profits. Users may suffer significant losses as a result of this.

Additionally, incorporating smart contracts poses a risk. Up until they are joined with contracts for another application, contracts for one application might be secure.

Another significant risk is the user. Due to DeFi’s complexity, the danger can increase when a user uses the network’s ability to be composed to connect with several protocols.

Final Thoughts

In conclusion, DeFi’s functionality depends heavily on composability. With the help of Ethereum’s permissionless network, anyone can utilize protocols in different combinations, taking advantage of the ecosystem’s interoperability. Additionally, developers can use their own contracts, strengthening Ethereum’s already strong network effects.

DeFi poses numerous hazards, yet a more composable Ethereum is essential for the ecosystem’s survival. As additional networks create their own financial apps, it’s possible that DeFi will experience greater cross-chain applications in the future with the smart contract composability feature.

It is distinct that the decentralized finance sector will surely succeed as developers are working diligently to make it better.

Work with Zeeve

Want to know more about the composability of smart contracts? Connect with Zeeve; we feature a robust set of APIs to build DApps for a plethora of use cases across industries, including asset tokenization, DEX, Stablecoins, etc. Zeeve supports Decentralized Finance (DeFi) space with decentralized storage, trusted nodes, and smart contracts.

To learn more about Zeeve, join us on Twitter and Telegram. Feel free to contact us directly.

Responses